Liquefied Natural Gas Price Trend: A Comprehensive Analysis and Market Outlook

Liquefied Natural Gas (LNG) plays a critical role in the global energy market as a versatile and efficient fuel source. However, its prices are influenced by various factors, including supply and demand dynamics, geopolitical events, and shifts in energy policies. Understanding the Liquefied Natural Gas Price Trend is essential for industry players, investors, and governments as they navigate this rapidly evolving market. This comprehensive guide provides insights into the LNG price trend, price analysis, recent news, price charts, and forecasts.

Request Free Sample – https://www.procurementresource.com/resource-center/liquified-natural-gas-price-trends/pricerequest

Liquefied Natural Gas Price Trend

The liquefied natural gas price trend has been highly volatile in recent years due to global shifts in energy demand and supply chain disruptions. LNG prices are affected by factors such as production levels, transportation costs, weather patterns, and shifts in global demand. As a result, prices fluctuate seasonally and regionally based on various market influences.

Historical Trends

Historically, LNG prices were relatively stable until the early 2000s. With the rise of LNG as a major energy source, prices began to show greater variability, particularly as new LNG facilities and export terminals were constructed. Additionally, demand for LNG from regions such as Asia and Europe has increased significantly over the years, leading to higher prices.

Recent Trends

In recent years, LNG prices have experienced dramatic swings. The COVID-19 pandemic initially led to a decrease in demand, causing LNG prices to drop sharply. However, as economies began to recover and global demand for energy surged, prices rebounded strongly. Moreover, geopolitical tensions, particularly in Europe, have caused disruptions in the natural gas market, driving prices even higher as countries seek alternative fuel sources.

The most recent liquefied natural gas price trend shows significant price spikes due to increased demand from European countries seeking alternatives to Russian gas. This trend has led to unprecedented price levels, especially in winter months when heating demands are high.

Liquefied Natural Gas Price Analysis

Analyzing the Liquefied Natural Gas Price Trend requires an in-depth look at the various factors that affect LNG prices. These factors include production costs, supply chain constraints, weather patterns, and geopolitical developments:

Production and Transportation Costs: The process of liquefying natural gas, transporting it, and then regasifying it at the destination is expensive. These costs are influenced by the price of raw materials, labor costs, and energy prices. Additionally, LNG prices often reflect the cost of natural gas extraction, which can fluctuate based on global energy market conditions.

Supply and Demand Dynamics: As an essential energy source, LNG is in high demand, particularly in Asia and Europe. Seasonal factors also play a role, with higher demand for LNG during winter months when heating needs rise. Additionally, economic growth in developing countries has contributed to increased demand for LNG, further influencing price trends.

Weather Patterns: Extreme weather events, such as hurricanes, can disrupt LNG production and transportation, leading to price spikes. For example, hurricanes in the Gulf of Mexico often impact LNG terminals, reducing supply and driving up prices. Conversely, milder-than-expected winters can reduce demand for heating, leading to a temporary decrease in prices.

Geopolitical Events: Geopolitical tensions can significantly impact LNG prices. For instance, the ongoing conflict between Russia and Ukraine has led European countries to seek alternatives to Russian gas, resulting in increased demand for LNG from other sources. Trade policies, sanctions, and diplomatic relations all play a role in determining LNG availability and pricing.

Energy Policies and Environmental Regulations: As countries transition towards cleaner energy sources, demand for LNG as a relatively low-emission fuel has increased. Environmental policies that encourage the use of natural gas over coal or oil further support LNG demand. However, stricter environmental regulations on LNG production and transportation could lead to higher costs, influencing price trends.

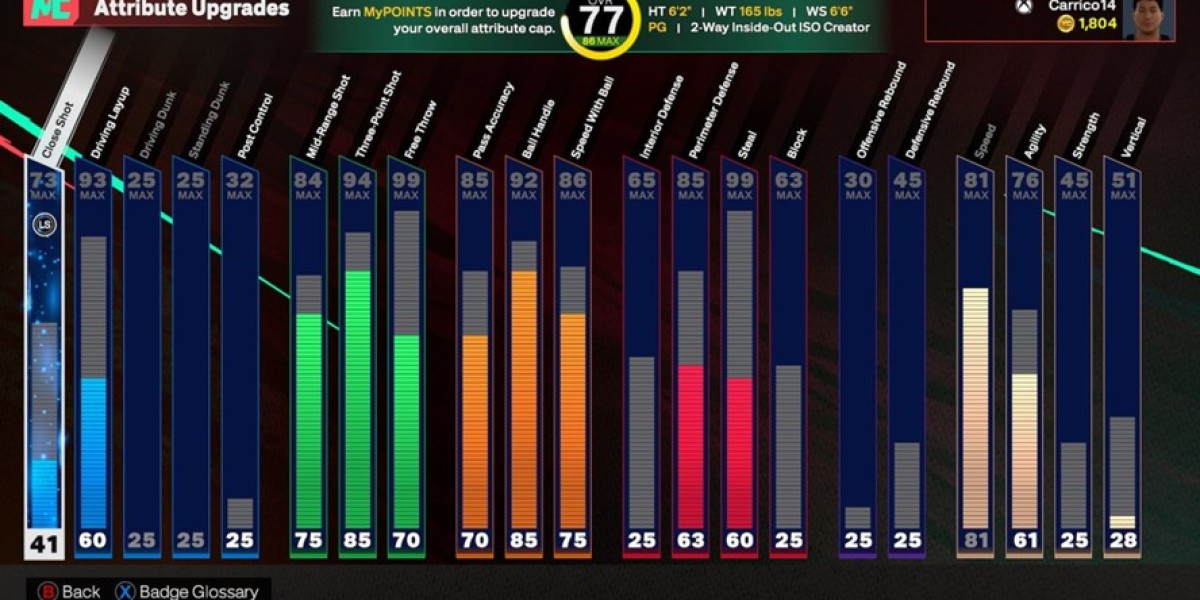

Liquefied Natural Gas Price Chart

A liquefied natural gas price chart offers a visual representation of price trends over time, allowing industry players and analysts to observe seasonal patterns, market reactions to specific events, and long-term shifts.

Typically, an LNG price chart will display data over a set period, such as monthly or yearly averages, illustrating how prices fluctuate seasonally. For instance, higher prices are often observed in the winter months when demand for heating is high, especially in northern hemisphere markets. On the other hand, prices can drop in the summer when demand is generally lower.

Analyzing a price chart for the past decade reveals various price spikes associated with events such as:

- The 2011 Fukushima disaster, which increased demand for LNG in Japan as nuclear power plants were shut down.

- The COVID-19 pandemic, which led to decreased demand and lower prices initially, followed by a rapid rebound as economies reopened.

- The recent energy crisis in Europe due to geopolitical tensions, which has pushed prices to new highs as countries seek to reduce reliance on Russian gas.

By examining a price chart, industry professionals can gain insights into recurring patterns and potential triggers for price changes, enabling them to make informed decisions based on historical data.

Liquefied Natural Gas Price News

Staying updated with the latest liquefied natural gas price news is crucial for industry participants, investors, and policymakers. News reports on weather forecasts, geopolitical developments, and market conditions can provide early indicators of potential price changes in the LNG market.

For example, recent news reports highlighted the impact of the Russia-Ukraine conflict on European energy markets, causing an increased reliance on LNG imports. As a result, European countries have been competing with Asian markets for LNG supplies, leading to higher prices globally. Additionally, news on production cuts or expansions at major LNG export terminals can influence market sentiment and price expectations.

News reports also cover weather forecasts, which are particularly relevant during the winter heating season. An unusually cold winter, for instance, can drive up LNG demand and lead to higher prices. Similarly, news on extreme weather events, such as hurricanes affecting the Gulf of Mexico, can signal potential disruptions in LNG supply and subsequent price increases.

By monitoring LNG price news, stakeholders can stay informed about potential market shifts and prepare for price fluctuations accordingly.

Liquefied Natural Gas Price Index

The liquefied natural gas price index is a useful tool for tracking changes in LNG prices over time relative to a base period. This index allows analysts and investors to measure price inflation for LNG and compare its performance with other energy sources, such as crude oil and coal.

The LNG price index is calculated based on average prices over a specific timeframe, offering a benchmark for observing price movements. A rising index indicates increasing prices, while a declining index suggests a downward trend. The index also provides a means for comparing the performance of LNG prices with other commodities, which can reveal insights into the broader energy market.

For instance, if the LNG price index rises faster than the oil price index, it may indicate stronger demand for LNG relative to oil, possibly due to environmental policies favoring natural gas over oil. Conversely, a declining LNG index could suggest reduced demand or increased supply, such as when new LNG export facilities come online.

Liquefied Natural Gas Price Graph

A liquefied natural gas price graph provides a visual depiction of the price trend, allowing users to quickly assess how LNG prices have changed over time. By plotting historical price data on a graph, patterns and significant price movements become more apparent.

For example, a price graph for LNG over the past decade might show steady price levels with seasonal fluctuations, followed by sharp spikes during events like the 2022 energy crisis in Europe. A graph that includes data from different regions, such as Asia, Europe, and the U.S., can also highlight regional differences in LNG pricing, reflecting factors such as transportation costs and local demand.

Additionally, a price graph can illustrate how specific events, such as natural disasters, affect LNG prices. A price graph that spans multiple years can provide valuable context, showing whether recent price movements are part of a longer-term trend or a temporary fluctuation.

About Us:

Procurement Resource is an invaluable partner for businesses seeking comprehensive market research and strategic insights across a spectrum of industries. With a repository of over 500 chemicals, commodities, and utilities, updated regularly, they offer a cost-effective solution for diverse procurement needs. Their team of seasoned analysts conducts thorough research, delivering clients with up-to-date market reports, cost models, price analysis, and category insights.

By tracking prices and production costs across various goods and commodities, Procurement Resource ensures clients receive the latest and most reliable data. Collaborating with procurement teams across industries, they provide real-time facts and pioneering practices to streamline procurement processes and enable informed decision-making. Procurement Resource empowers clients to navigate complex supply chains, understand industry trends, and develop strategies for sustainable growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Amanda Williams

Email: [email protected]

Toll-Free Number: USA Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA